Financial Advisor Website Guide: Complete SEO Buyers Checklist for RIAs

Financial advisor marketing is getting harder. That makes choosing the right website and SEO partner more important than ever. In today’s digital-first world, standing out online isn’t a nice-to-have—it’s essential. This guide pulls from our experience helping RIAs and financial advisors since 2017 so you can make a smarter, more confident decision for your firm’s growth.

Should I hire a digital marketing company that specializes in financial advisors?

Yes, hiring a digital marketing agency that specializes in financial services—especially independent RIAs—can give you a major advantage. These agencies understand compliance requirements, the importance of thought leadership, and how to implement local SEO for financial advisors that target high-intent searches in your market.

Rather than search by generic terms, look for niche expertise using queries like:

- digital marketing for financial advisors

- SEO for RIAs and wealth management firms

- compliance-ready marketing for independent advisors

Is digital marketing essential for financial advisors to get clients?

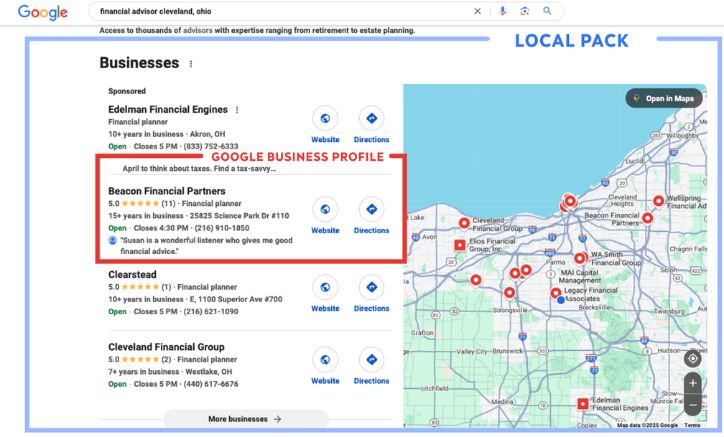

Yes. Without digital marketing, it’s nearly impossible to compete online—especially for local visibility. Start by comparing your firm’s search rankings for local intent keywords like “retirement planning near me” or “fee-only financial advisor.”

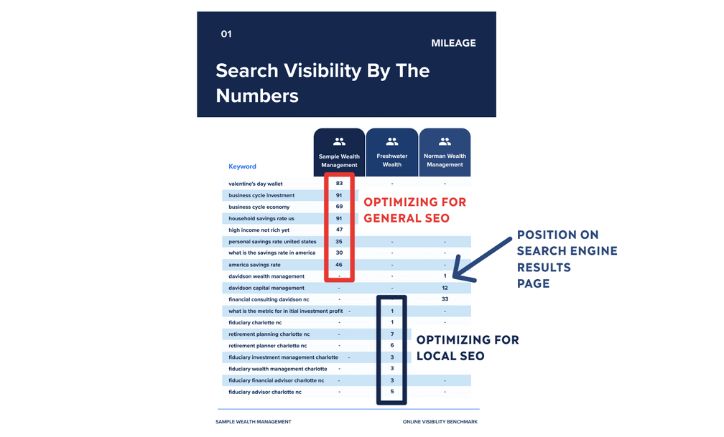

We recommend creating a short list of 10–12 local, non-branded keyword phrases and evaluating your position compared to competitors.

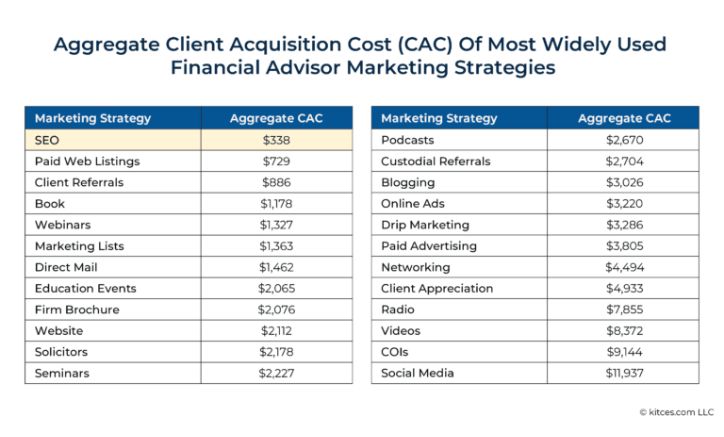

SEO ranks 2nd for marketing efficiency, just behind client referrals. Despite these rankings, only 22% of advisors in the survey used SEO as part of their marketing strategy.¹

How can I compare my local SEO ranking against my competitors?

Use tools like Google Search Console, Moz, or SEMrush to compare how your site ranks for local, non-branded keywords. Focus on terms like:

- financial advisor near me

- retirement planner [your city]

- fee-only advisor [your area]

- wealth management services [your location]

Exclude branded terms (e.g., “[Your Company] [City]”)—those searches already know you. The goal is to see how often new prospects find you online.

Our technical SEO team will prepare a complementary comparison just like this — Contact us for a free keyword comparison audit.

How can I tell if a digital marketing company will solve my problems — not just sell services?

Listen to how they talk about strategy. Strong partners spend more time diagnosing your current SEO position and less time pitching services. Ask them how they’d improve visibility of your financial advisor website using local keywords or how they’d measure success. Competence is shown by their questions — and their answers.

What questions should I ask a digital marketing agency to see if they understand my SEO problems?

- What are the biggest SEO challenges you’ve solved for other RIAs or financial advisors?

- Can you show local keyword ranking improvements for past clients?

- How would you assess my current search visibility?

- How do you approach content that meets compliance requirements?

- What’s your experience with FINRA and SEC marketing regulations?

Given all of the technical complexities and required knowledge that come with designing and implementing effective SEO strategies, SEO will almost always need to be an outsourced activity.³

How much of the conversation should be about the agency’s experience, and how much about my problems?

Roughly 30% should be about their credentials and past work. The other 70% should focus on your unique challenges, audience, and market. If the conversation is too one-sided, they may be more interested in closing the sale than solving your problem.

What’s the difference between local SEO and general SEO—and which is better for financial advisors?

The difference between local SEO and general SEO is the search intent and geographic focus. General SEO improves visibility for broad, national searches. Local SEO targets location-specific searches like “retirement planning [city].”

For financial advisors, local SEO is far more effective—it captures users with commercial intent who are actively looking for a financial partner nearby.

Why is local SEO more likely to bring in paying clients for financial advisors?

Local SEO for Financial Advisors comes with commercial intent — it targets people ready to act. Someone searching “retirement planner near me” is far closer to becoming a client than someone searching “what’s the average savings rate in America.” Local SEO meets prospects at the decision-making stage—and that’s exactly where you want to be.

Local SEO is important if you serve clients in a particular area. Because it helps your business show up in location-based search results.²

What are examples of local keywords financial advisors should be ranking for?

- financial advisor in [your city]

- retirement planning near me

- fee-only advisor [your region]

- tax planning [your city]

- wealth management [your area]

- estate planning advisor [your location]

Our Local SEO strategy includes targeting these kinds of high-intent keywords that convert browsers into clients.

What metrics should financial advisors use to measure digital marketing success?

- Qualified Leads: How many people became clients from online efforts?

- Search Rankings: What position do you appear in for local terms like “financial advisor [your city]”?

- Website Traffic: Track monthly visits, but focus more on quality than volume.

- Consultation Requests: How many prospects book discovery meetings?

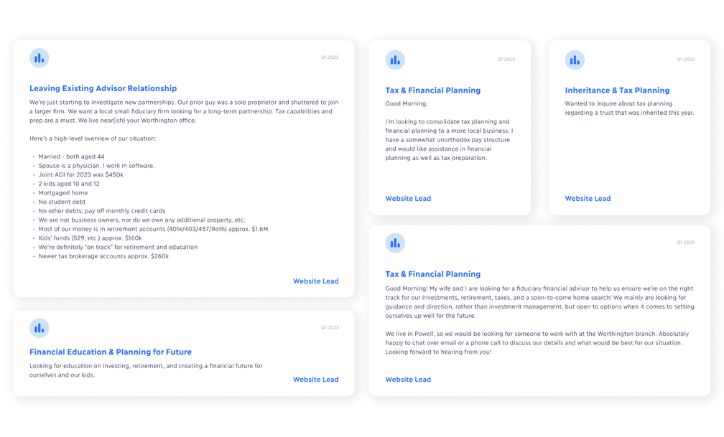

What is a qualified lead? Leads like these from an Independent RIA:

Bonus: Track customer acquisition cost and client lifetime value to understand true ROI. We help clients map these outcomes during our Digital Marketing Strategy engagements.

How do I determine the lifetime value of a client acquired through local SEO?

Start with your average client’s assets under management (AUM) and your annual fee structure. Multiply that by the expected number of years you’ll serve them. For example:

- $500,000 AUM × 1% fee = $5,000/year

- 10-year client lifespan = $50,000 lifetime value

Compare this to your marketing spend to determine return on investment. We walk clients through this process in our strategic consultations.

Is original content or a content library better for financial advisor marketing?

Original content is far better. Google favors content that’s unique, helpful, and directly answers a searcher’s question. Content libraries—often used by dozens or hundreds of firms—don’t perform well in search results.

Instead, work with a team that develops original content tailored to your client’s questions, goals, and market positioning.

Why does Google prefer original content over content from a library?

Because original content provides value that isn’t duplicated elsewhere. When hundreds of advisors use the same content library, Google struggles to decide who deserves to rank. They’ll try to determine which result is most relevant to the particular search query, but there’s a chance they’ll get it wrong.⁴

Unique, tailored content makes it easier for Google to identify your site as the best match for the searcher—and that’s what gets you visibility. Our advisor marketing insights are always original and strategically focused on your growth.

How can a financial advisor measure their marketing ROI — and what should they do if they’re unsure?

Start with this formula:

ROI = (Revenue from New Clients – Marketing Cost) ÷ Marketing Cost

If you’re unsure what goes into that calculation, we’ll help you track results—no pressure, just insights. Our goal is to help you make confident decisions with clarity, not sales pressure.

Many agencies sell SEO. Few specialize in solving problems for RIAs. At Mileage Design, we focus on SEO for financial advisors that works. If you’re unsure whether your marketing is driving results, we’ll help you measure your ROI—free of charge. If you’re in a good place already, we’ll keep cheering for you.

Your Financial Advisor Website Success Checklist

Before investing in a new website or SEO strategy, ensure your partner understands:

- Compliance Requirements: FINRA and SEC marketing regulations

- Local SEO Strategy: Targeting high-intent, location-based searches

- Original Content Creation: Unique, valuable content that Google rewards

- ROI Measurement: Clear tracking of leads, clients, and revenue attribution

- Technical SEO Foundation: Fast, mobile-optimized, conversion-focused design

Ready to evaluate your current digital marketing performance? Contact us for a free consultation and discover how strategic SEO can transform your practice’s growth.

References

- Kitces: Advisor Marketing Strategy and Client Acquisition Costs

- SEMrush: SEO for Financial Services

- Kitces: Outsourcing SEO for Financial Advisors

- Neil Patel: Myths About Duplicate Content